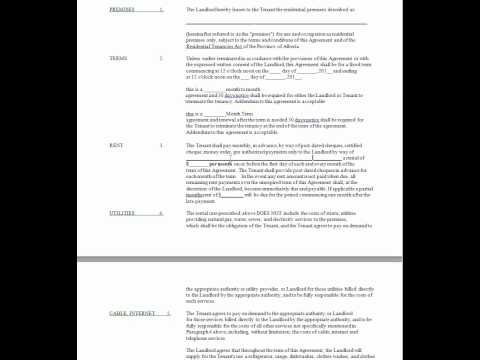

Okay, this one's going to take a little bit longer to explain. This is the residential tenancy agreement, and most likely you're going to have to read this and understand it yourself. Go through it and understand one thing here: This is the date the disagreement is basically being made. Next, right here, you have the name of the owner or the designated individual that is in charge or the manager, or whoever it is. And then, what you next have is their address. What the addresses of the individual. Then you have the names of the residents, all of the residents that are in the unit are the ones taking financial responsibility. Right over here, next, what you have is the address of the property itself, the premises. Next, what you have is the date that the terms of this agreement are beginning. So, it's going to be whatever date of whatever month of whatever year, ending at whatever date, month, or year. Unless it's a month-to-month agreement, then it's a thirty days notice. They're going to be required. And there is also a six or twelve or twenty-four, or whatever month term agreement that we have here as well. And this agreement, in a renewal, that we need to, you need to renew this term agreement at the end of the term, or basically, the tenant needs to be able to move. Now, of course, an addendum is acceptable. Whatever you can negotiate, there's a lot of leeway in regards to whether it's a month or a term. You can give bonuses, you can put rent up, put rent down, you can give money back, you can pay for utilities, you can pay for what I mean, basically, it's whatever you can put your imagination to, whether it's...

Award-winning PDF software

Example of commercial lease agreement Form: What You Should Know

Commercial Lease Agreement Template — Word This lease is for both landlord and tenant of commercial or residential property. This form is commonly used by businesses. Commercial Lease Agreement Template Free | Word & PDF This commercial lease agreement is the legal template for all commercial land leases. It details the essential parameters for each tenant and landlord in Temple CB, LLC Liability for a Commercial Lease Template Free | Word & PDF A commercial lease agreement may be used to address the financial and business aspects of leasing out residential property. In this document, a Commercial Lease Agreement Free | Word & PDF This lease allows both premises to be used for commercial purposes, and sets forth the tenant's rights and responsibilities. A Temple CB, LLC Temple CB, LLC Free Commercial Land lease Agreement — Word & PDF This lease allows both premises to be used for commercial purposes, and sets forth the tenant's rights and responsibilities. A Temple CB, LLC — Commercial/Residential Land Lease Template This commercial land lease agreement is similar to a general residential lease, but includes specific requirements regarding the usage and TEMPLE CB, LLC Temple CB, LLC In this particular document, the tenant can have a maximum lease duration of 3 Temple CB, LLC- Commercial/Residential Land Lease for Single Family Homes Template This document does not provide specific lease terms, but makes a specific agreement about the conditions for the leasing Temple CB, LLC — Commercial/Residential Property Lease Template Businesses may lease commercial property as often as they want.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Month To Month Rental Agreement, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Month To Month Rental Agreement online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Month To Month Rental Agreement by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Month To Month Rental Agreement from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Example of commercial lease agreement